1099-NEC or 1099-MISC

Informational Guide - What has Changed and Why it Matters

In a move that will impact business owners and tax professionals across the nation, the IRS has released the 2020 Form 1099-NEC. The new form replaces Form 1099-MISC for reporting nonemployee compensation (in Box 7), shifting the role of the 1099-MISC for reporting all other types of compensation.

As a result of the new 1099-NEC and redesigned 1099-MISC, the overall process for reporting nonemployee compensation is changing for the 2020 tax year. We have compiled the essential details regarding the changes, so you know what to expect and how to handle the forms properly

Why is the 1099-NEC Replacing Form 1099-MISC (Box 7)

The Protecting Americans from Tax Hikes Act of 2015 (the PATH Act) -- enacted on December 18, 2015 – created a unique situation for tax filers. In addition to moving the due date for Form 1099-MISC Forms containing data in Box 7; (nonemployee compensation), from February 28 to January 31, the legislation eliminated the automatic 30-day filing extension. If an employer filed a batch of multiple 1099-MISC forms (potentially with data in Box 7 (nonemployee compensation) and without) after the January 31st deadline, the IRS could mistakenly treat them all as late returns and apply fines

Beyond the time-management and administrative issues for the IRS to properly process the forms, some misaligned deadlines on the taxpayer side opened the door to fraud. To resolve the various issues, the IRS revived Form 1099-NEC, effectively separating Box 7 (nonemployee compensation) from the 1099-MISC, as well as staggering the filing due dates

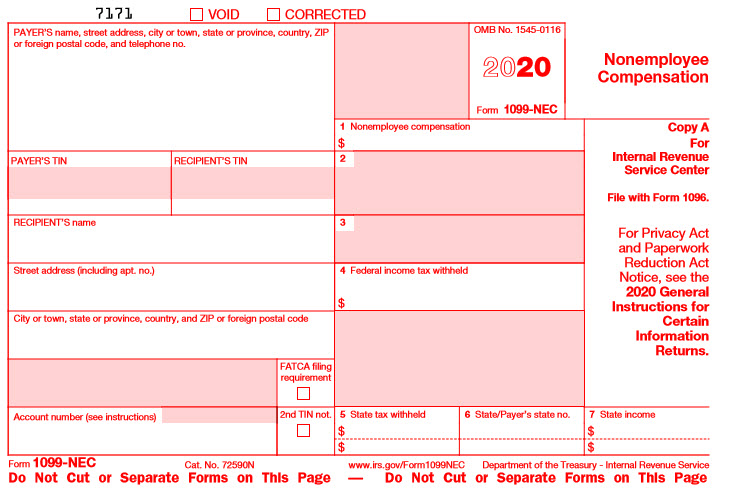

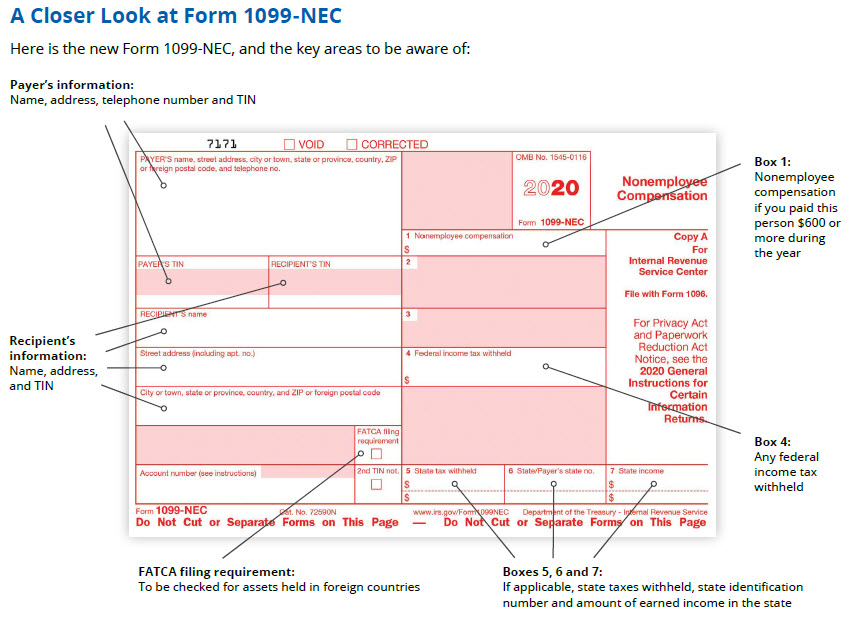

2020 Instructions for Form 1099-NEC

The new 1099-NEC (NEC stands for Non-Employee Compensation) is based on an old form that has been out of use since 1982. To use the reinstated 1099-NEC properly, you need to understand what is considered nonemployee compensation. Previously reported on Box 7 of the 1099-MISC, the new 1099-NEC will capture any payments to nonemployee service providers, such as independent contractors, freelancers, vendors, consultants and other self-employed individuals (commonly referred to as 1099 workers).

- It is made to someone who is not your employee

- It is made for services in the course of your trade or business

- It was made to an individual, partnership, estate, or, in some cases, a corporation

- Payments were $600 or more for the calendar year

Exceptions

Payments for merchandise, telegrams, phone, freight, storage or similar items and Payments to a tax-exempt organization, including tax-exempt trusts; federal, state, and local governments; or a foreign government

Critical Do and Do not with Form 1099-NEC

- Do verify that the recieving taxpayer ID is correct. You must have Form W-9 from each recipient with the current taxpayer ID before you complete Form 1099-NEC

- Do not use Form 1099-NEC to report personal payments

- Do not use Form 1099-NEC to report employee wages; use Form W-2 instead

- Do not report gross proceeds to an attorney (not fees) on Form 1099-NEC; use Form 1099-MISC instead

- Do not use Form 1099-NEC to report payments of rent to real estate agents or property managers; use Form 1099-MISC instead

Filing and Submitting Form 1099-NEC

Distribute to recipients by January 31. (For 2021, the date is Feb. 1, since Jan. 31 falls on a Sunday). File with the IRS by Jan. 31 (again, Feb. 1 in 2021) through paper or electronic filing As part of the Taxpayer First Act, many businesses will no longer be able to submit paper forms. For tax year 2020, the electronic filing threshold is 100 forms. Which means any business with 100 forms or more are required to e-file Please note: You must also file Form 1099-NEC (report in box 4) for anyone from whom you withheld federal income tax under the backup withholding rules, regardless of the amount

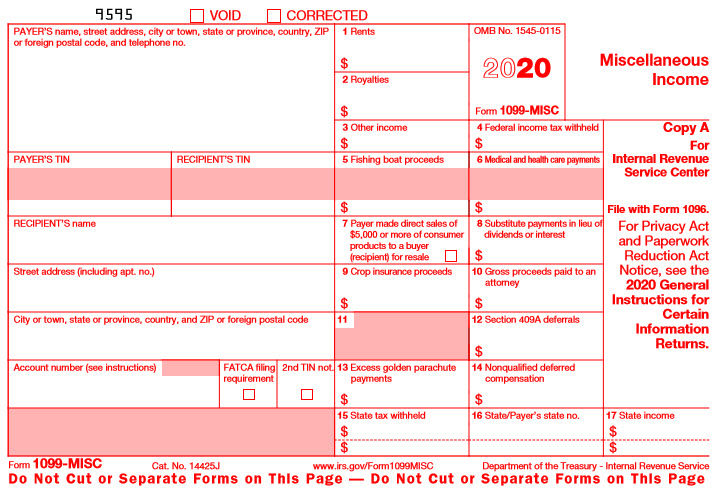

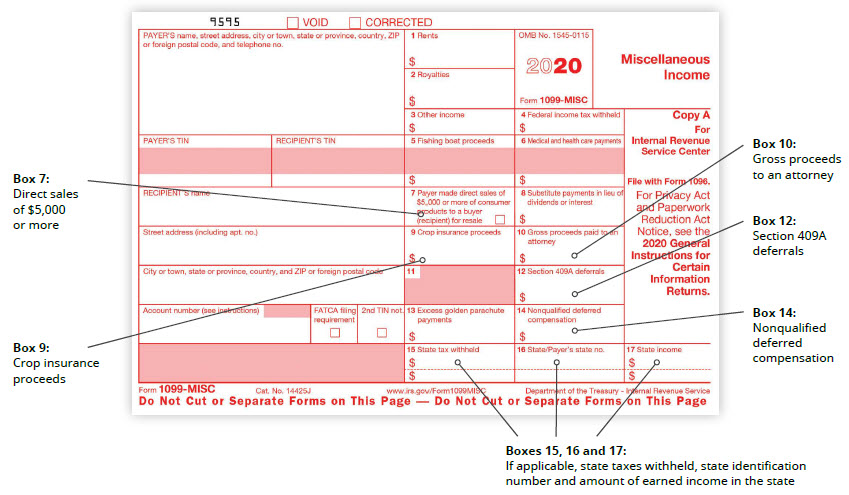

2020 Instructions for Form 1099-MISC

Because nonemployee compensation reporting has been removed from Form 1099-MISC for the 2020 tax season and beyond, the IRS has redesigned Form 1099-MISC

The biggest change is Box 7, which was previously used for reporting nonemployee compensation. The revised form includes other changes to the box numbers for reporting miscellaneous compensation, as follows:

Critical Do and Do Not with Form 1099-MISC

- Do report gross proceeds to an attorney (not fees) on Form 1099-MISC

- Do complete a 1099-MISC if you made royalty payments of at least $10 during the year

- Do use Form 1099-MISC for miscellaneous income, such as rents, royalties, and medical and health care payments

- Do not use Form 1099-MISC to report personal payments

- Do not use Form 1099-MISC to report employee wages; use Form W-2 instead

Filing and Submitting Form 1099-MISC

Distribute to recipients by January 31. (For 2021, the date is Feb. 1, since Jan. 31 falls on a Sunday). File with the IRS by Feb. 28 (Mar. 1 in 2021) if filing by paper, Mar. 31 if filing electronically. As part of the Taxpayer First Act, many businesses will no longer be able to submit paper forms. For tax year 2020, the electronic filing threshold is 100 forms. Which means any business with 100 forms or more are required to e-file. Please note: You must also file Form 1099-MISC for anyone from whom you withheld federal income tax under the backup withholding rules, regardless of the amount

W2 Forms Blank Forms Tax Envelopes Tax Software Misc Forms Wage Forms Pressure Seal Forms

Shipping and Packaging

Everything you need to make your shipping, mailing and packaging move smoothly

Mailroom - Envelopes - Boxes - Labels and Seals - Forms - Mailers - Bubble Wrap - Mailing Tissue - Filler Shred

Office Essentials

Everything you need to make your daily office operations run smoothly.

Money Handling - Portfolios - Stamps - Binders - Forms - File Folders - Storage - Accessories - Corporate Gifts